Meme index diversified represents a potential solution for navigating the notoriously volatile yet captivating meme market, known for high potential returns alongside significant risks. This approach helps investors access the unique segment more systematically by grouping various meme assets into one basket, aiming to minimize risks compared to betting everything on a single meme.

Contents

What is a meme index diversified?

First, let’s understand “meme” in a financial context. It typically refers to assets, mainly stocks (meme stocks) or cryptocurrencies (meme coins), whose value surges not based on the fundamental performance of the company or project, but primarily driven by social media hype, exaggeration, and herd mentality. Names like Gamestop, AMC, Dogecoin, or Shiba Inu are classic examples.

An “index” is a tool used to measure the performance of a specific group of assets. For instance, the S&P 500 index tracks 500 of the largest companies in the United States.

“Diversified” refers to diversification, a fundamental principle in investing, meaning not putting all your eggs in one basket. By allocating capital across various assets, investors can mitigate the risk of loss if one particular asset performs poorly.

Combining these terms, a Meme index diversified is a type of index or investment portfolio constructed by gathering various meme stocks and/or meme coins. Its main objective is to offer investors exposure to the potential growth of the entire meme market while dampening the extreme volatility and risk associated with holding only one or two individual meme assets.

Why diversify when investing in memes?

Investing in individual meme assets is extremely risky. Their prices can skyrocket by hundreds, even thousands of percent in a short period, but they can also plummet drastically within hours or days. This volatility is often unpredictable and heavily depends on psychological factors, viral news, or even tweets from influential figures.

Trying to pick the next winning meme asset is like finding a needle in a haystack. By investing in a meme index diversified, you don’t need to guess precisely which asset will explode. Instead, you bet on the overall performance of a basket of popular or potentially promising meme assets. If a few assets within the index perform poorly, that decline might be offset by the strong performance of others.

How does a meme index diversified work?

A meme index diversified is typically created and managed by an organization or platform (although currently, official, heavily regulated products are quite rare). This process usually involves these steps:

- Asset selection: Defining criteria for including meme stocks or coins in the index. Criteria might include market capitalization, trading volume, social media popularity, or other factors.

- Weight allocation: Deciding the proportion (weight) of each asset within the index. This could be equal weighting for all, based on market cap, or use a more complex methodology.

- Rebalancing: Periodically adjusting the weights of the assets in the index to ensure it continues to reflect its original objective. For example, if one meme coin’s price surges excessively, the index might sell some of it and buy more of other assets to maintain diversification.

Investors might access such indexes (if available) through derivative financial products, specialized exchange-traded funds (ETFs) (currently not widespread), or by building their own personal portfolios following a similar strategy.

Benefits of a meme index diversified

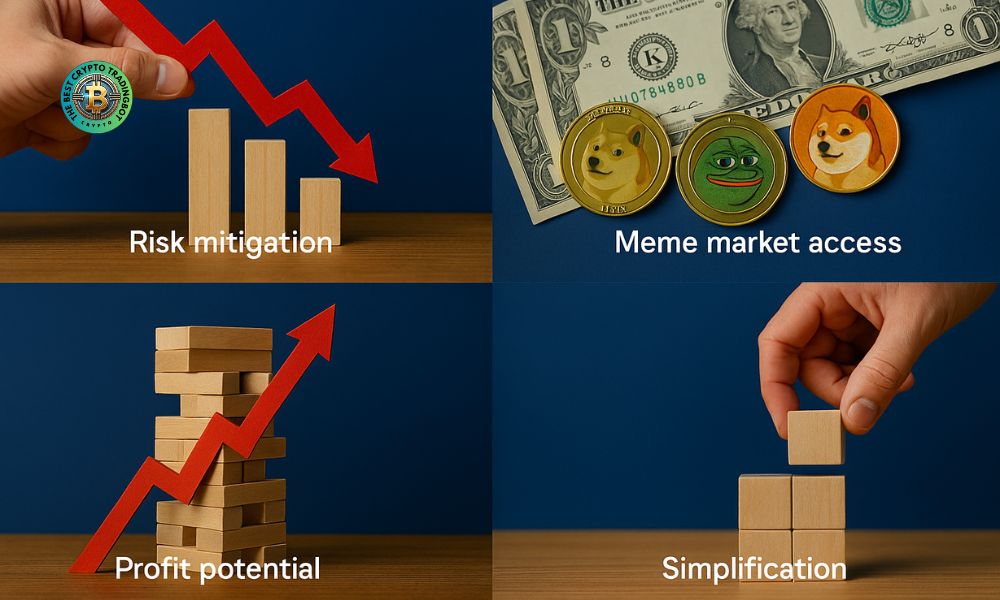

Risk mitigation: This is the primary benefit. Diversification helps reduce the negative impact if a single meme asset collapses.

Meme market access: Provides an easier way to participate in the meme investment space without needing deep research into each individual asset.

Profit potential: Still retains the potential to benefit from the overall growth of meme trends in the market.

Simplification: Can be simpler than constantly monitoring and managing multiple individual meme positions.

A Meme index diversified represents an attempt to apply a traditional investment principle (diversification) to the nascent and highly volatile market segment of meme assets. It offers a chance to access the potential growth of the entire meme ecosystem while trying to mitigate the extreme risks of holding single assets. However, investors must clearly understand that this remains a very high-risk form of investment. For more in-depth analysis, knowledge, and the latest news about the world of memes and related investment strategies, make sure to regularly visit and follow The Best Crypto Tradingbot!