Are you wondering what does USDT stand for and its significant role in the cryptocurrency market? USDT, short for United states dollar tether, is a stablecoin meticulously designed to maintain a 1:1 value peg with the US dollar. This unique feature helps investors mitigate the price volatility commonly seen in the dynamic world of cryptocurrencies, offering a more stable digital asset.

Contents

What does USDT stand for?

To understand what does USDT stand for, it’s essential to know it represents United States Dollar Tether. This is a type of cryptocurrency issued by the company Tether Limited. The distinctive and core value of USDT lies in its ‘tethering’ or pegging to the value of the United States dollar (USD) at a 1:1 ratio. This theoretically means that every single USDT token issued is backed by an equivalent US dollar held in reserve by Tether Limited.

The primary objective behind creating USDT was to provide a stable value solution within the crypto market, where other coins like Bitcoin or Ethereum frequently experience significant price fluctuations. Thanks to USDT, traders and investors can:

- Convert their crypto assets into a stable “digital cash” form without completely exiting the crypto ecosystem.

- Minimize risk during adverse market movements.

- Execute fast transactions between exchanges without going through traditional banking systems.

The Operational Mechanism of USDT: A Step-by-Step Guide

The core idea behind USDT is to maintain a stable value, pegged 1:1 to the US dollar. Here’s how that mechanism is designed to work:

Foundation: The 1:1 Peg Promise: Tether Limited, the issuer, asserts that each USDT token is intended to be valued at approximately one US dollar.

Issuance of New USDT (Creation):

- When there is demand for new USDT (typically from large institutions or exchanges), these entities can provide US dollars (or other approved fiat currencies/assets) to Tether Limited.

- In return, Tether Limited “mints” or issues a corresponding amount of new USDT tokens to that entity. For example, if an institution deposits $1 million USD, Tether Limited would issue 1 million USDT.

Backing by Reserves (Collateralization)

- Tether Limited states that every USDT token issued is backed by an equivalent value of assets held in its reserves.

- Initial Claim: Originally, these reserves were purported to consist entirely of actual US dollars held in bank accounts.

- Current Composition (Diversified & Debated): Over time, and as per Tether’s own attestations (which have been a subject of public scrutiny and debate regarding their completeness and auditability), the composition of these reserves has diversified. They now reportedly include: Cash and cash equivalents: Actual fiat currency, short-term treasury bills, money market funds. Secured loans: Loans made by Tether to other entities (stated as not being to affiliated entities). Corporate bonds, funds, and precious metals: Investments in corporate debt, investment funds, and commodities like gold. Other investments: This can include investments in other digital currencies.

- The crucial point is that the total value of these diverse assets in reserve is supposed to equal or exceed the total value of all USDT in circulation.

Acquisition by General Users

- Direct Purchase (Large Scale): As mentioned in step 2, large institutions can acquire newly minted USDT directly from Tether Limited.

- Exchange Purchase (Retail/Most Users): The vast majority of users acquire USDT by purchasing it on cryptocurrency exchanges. They can buy USDT using fiat currency (like USD, EUR, VND) or by trading other cryptocurrencies for it (e.g., trading Bitcoin for USDT).

Redemption of USDT for Fiat Currency (Theoretically)

- Direct Redemption (Large Scale): Verified, large-scale clients of Tether Limited can theoretically redeem their USDT directly with the company. They would send USDT back to Tether Limited, and in return, Tether Limited would provide them with the equivalent amount in US dollars (or other agreed-upon fiat) from its reserves. This process should also “burn” or remove the redeemed USDT from circulation.

- Practical “Redemption” for Most Users (Selling on Exchanges): For most retail users, the “redemption” process happens on exchanges. They sell their USDT on an exchange for fiat currency or another cryptocurrency. The buyer on the exchange is then the new holder of that USDT. The stability of the peg relies on market participants believing that USDT is indeed backed and ultimately redeemable (even if indirectly for most) for ~$1.

In essence, the operational mechanism, which helps clarify what does USDT stand for in practical terms, relies on Tether Limited issuing tokens against deposited assets, maintaining reserves to back these tokens, and providing a (primarily large-scale) mechanism for redeeming tokens back into fiat. For the average user, the 1:1 peg is largely maintained by market supply and demand on exchanges, underpinned by the broader belief in Tether’s ability to honor redemptions.

How to buy and store USDT safely?

Buying USDT: You can purchase USDT on most major cryptocurrency exchanges such as Binance, Huobi, KuCoin, OKX, or via P2P platforms.

Storing USDT:

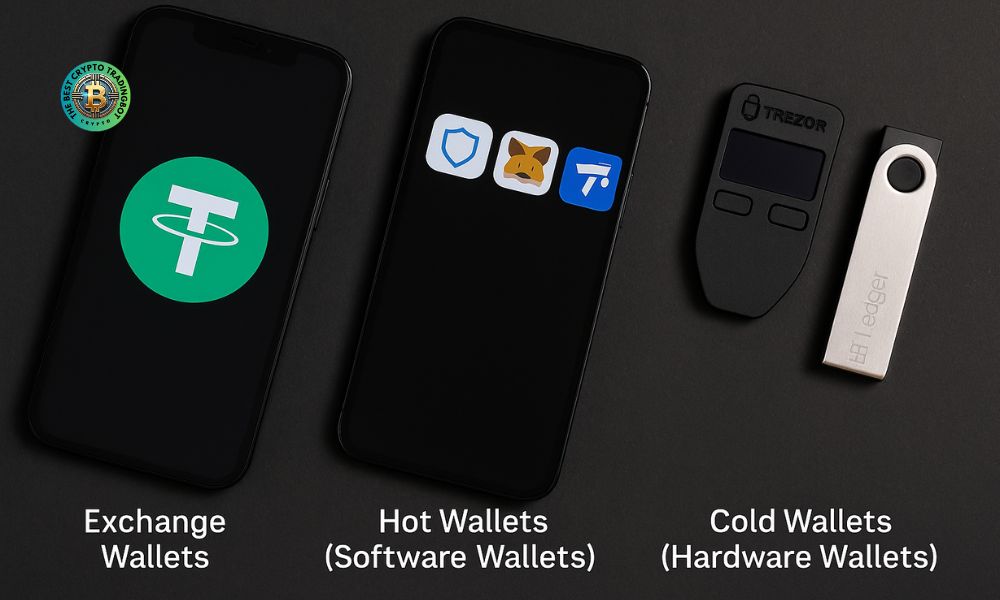

- Exchange Wallets: Convenient for frequent trading but generally less secure.

- Hot Wallets (Software Wallets): Examples include Trust Wallet, MetaMask (for ERC-20 or BEP-20 USDT), TronLink (for TRC-20 USDT). These offer a balance between convenience and security.

- Cold Wallets (Hardware Wallets): Examples include Ledger, Trezor. This is the most secure option for storing large amounts of USDT long-term, as private keys are kept offline.

When transacting or storing USDT, always pay close attention to the blockchain network you are using (e.g., ERC-20, TRC-20, BEP-20) to avoid sending to the wrong address and losing your assets.

Understanding what does USDT stand for—United States Dollar Tether—reveals its vital role as a stablecoin offering market stability. It’s a cornerstone for many crypto traders. For more essential crypto insights and news, ensure you follow The Best Crypto TradingBot and stay ahead in this dynamic space!